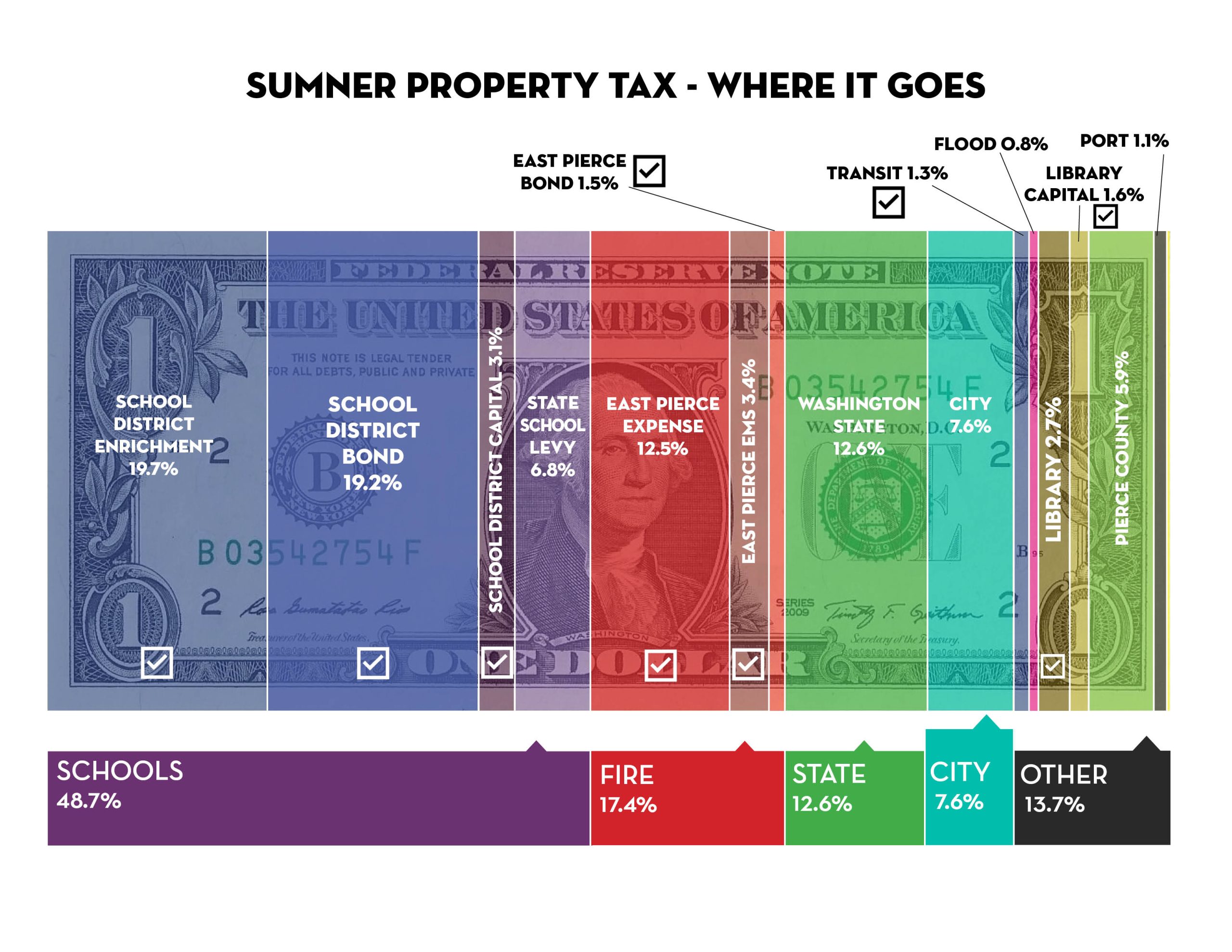

Property Tax Rate

City portion is 7.6% of your property tax bill. Link to the Pierce County Assessor-Treasurer for information about your property. For more information about funding the City receives and what it pays for, visit our Budget in Brief.

In general, here’s where your property tax bill goes:

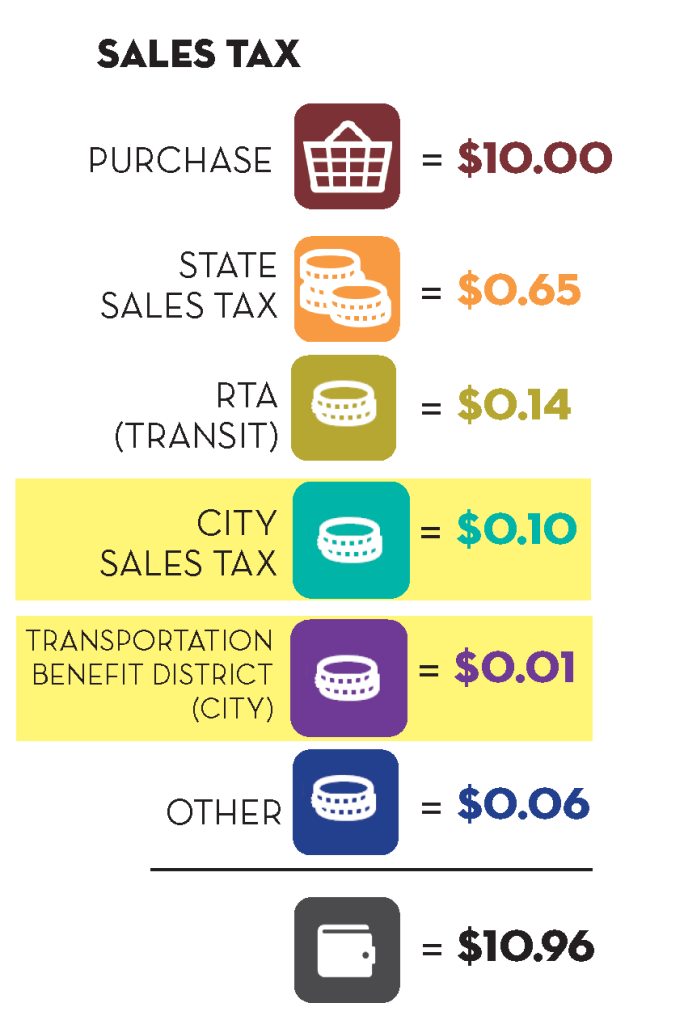

Sales Tax Rate

Sales Tax Rate

The total Sales Tax Rate in Sumner is 9.6%, paid by shoppers on non-food items purchased. Of this tax collected, 68.4% goes to the State of Washington, 14.7% to the regional transit authority (Sound Transit), 10.5% to City of Sumner, and 0.1% each to communication services, criminal justice, juvenile facility, mental health, and the zoo & aquarium, which together make up the “Other” category in the graph below. Starting in 2026, the City also has a Transportation Benefit District that collects 0.1%. Those funds come to the City but can only be used for transportation projects including the maintenance of roadways.

The State of Washington has a sales tax look-up app. Click here for more information

Business & Occupation (B&O)Tax

Sumner does not have a B&O tax over and above the State tax.

Utility Fund Tax

6% paid by utility customers on their water-sewer utility, the refuse utility, and the storm sewer utility

Commercial Parking

15% gross proceeds any business charging for commercial parking

Lodging Tax

5% for facilities with 26 rooms or more/2% for facilities with 25 rooms or less goes to Pierce County for allocation to support tourism plus a 2% occupancy tax that goes to City of Sumner to support tourism and $0.50 per room night collected for Pierce County’s Tourism Promotion Area paid by guests of the hotel on their room bill.

Gambling

Bingo and raffles 5% of gross receipts (except charities holding one event per year and earning less than $10,000); punchboards and pull tabs 5% of gross receipts; paid by business offering gambling at their establishment/event

Real Estate Excise Tax

0.25% of selling price paid by property owners to the Pierce County Treasurer at closing

Other State Taxes

Get more information from the Washington State Department of Revenue.